You should be entering the sell transactions for the management fees.shares sold, share price AND the cash balance. I'm leaning towards making the extra transactions but any insight is appreciated!ĮDIT: Forgot to offer option 3: instead of a misc transaction, should I record the cost into the commission field? The downside being I'm not recording into a category I create specifically to track 401k fees.

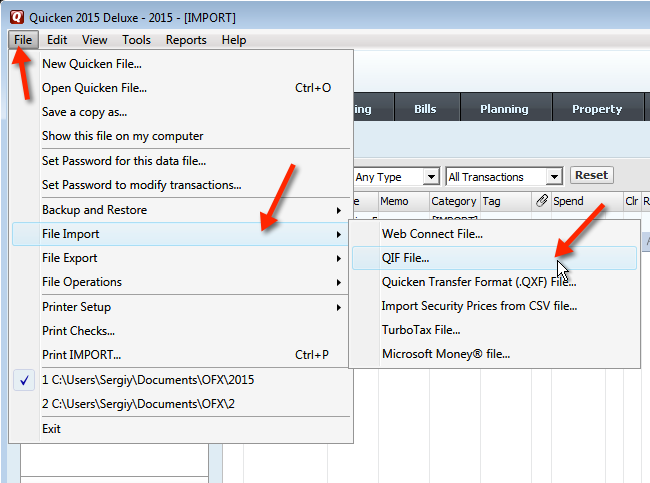

General question: These funds are listed on the markets and have valid symbols short of renaming the fund to the stock symbol, is there a way to import via QIF by stock symbol? Guessing not. Question: Am I ok importing QIFs with only I and Q (decrease shares via Sell but do not increase cash balance) or will things go haywire in the database with this "lost" money? Or do I play it safe (and increase my workload and database size) by adding the T flag to the Sell QIFs (increasing cash balance upon import), and creating an extra misc expense transaction to remove the cash? Looks like the extra transaction would be NCash and L (based on how my QIF export looked)? If I manually open/edit the transaction inside Quicken, the cash total is listed in the box, but does not get added to the cash balance unless I process the edited transaction. The transaction imported, properly decreased the share balances, but given the absence of a T (total) flag, did NOT increase the cash balance. Scenario: Created QIF transactions for the investment management fees (two per fund per quarter) using Sell with only the I and Q flags (price and quantity). Given the processing time of entering transactions in Quicken manually vs time setting up and importing a QIF, I am doing the latter. The investment manager does not break out share balances nor classifies transaction types between traditional and Roth (I have both), so using the QFX information is a no-go. I'm manually creating QIFs for my 401(k) transactions from the transaction history of the investment manager's website.

0 kommentar(er)

0 kommentar(er)